If the fixed costs have also been paid, the remaining revenue is profit. In the Dobson Books Company example, the total variable costs of selling $200,000 worth of books were $80,000. Remember, the per-unit variable cost of producing a single unit of your product in a particular production schedule remains constant. It is important for you to understand the concept of contribution margin. This is because the contribution margin ratio indicates the extent to which your business can cover its fixed costs. Direct materials are often typical variable costs, because you normally use more direct materials when you produce more items.

What is the approximate value of your cash savings and other investments?

- This situation needs urgent attention to either reduce variable costs or increase sales revenue.

- This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced.

- This is because it indicates the rate of profitability of your business.

This means not only looking at overall revenue and net profit but also examining the contribution margin of each product or service line. This practice can reveal trends and patterns, helping business owners make proactive adjustments in their operations, pricing, and marketing strategies. If the contribution margin for an ink pen is higher than that of a ball pen, the former will be given production preference owing to its higher profitability potential. The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources. Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them.

Why You Can Trust Finance Strategists

Formerly a reporter, Soundarya now covers the evolving cybersecurity landscape, how it affects businesses and individuals, and how technology can help. You can find her extensive writings on cloud security and zero-day attacks. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

What is your current financial priority?

A university van will hold eight passengers, at a cost of \(\$200\) per van. If they send one to eight participants, the fixed cost for the van would be \(\$200\). If they send nine to sixteen students, the fixed cost would be \(\$400\) because they will need is sales revenue a debit or credit in business two vans. We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be \(\$200\). If they exceed the initial relevant range, the fixed costs would increase to \(\$400\) for nine to sixteen passengers.

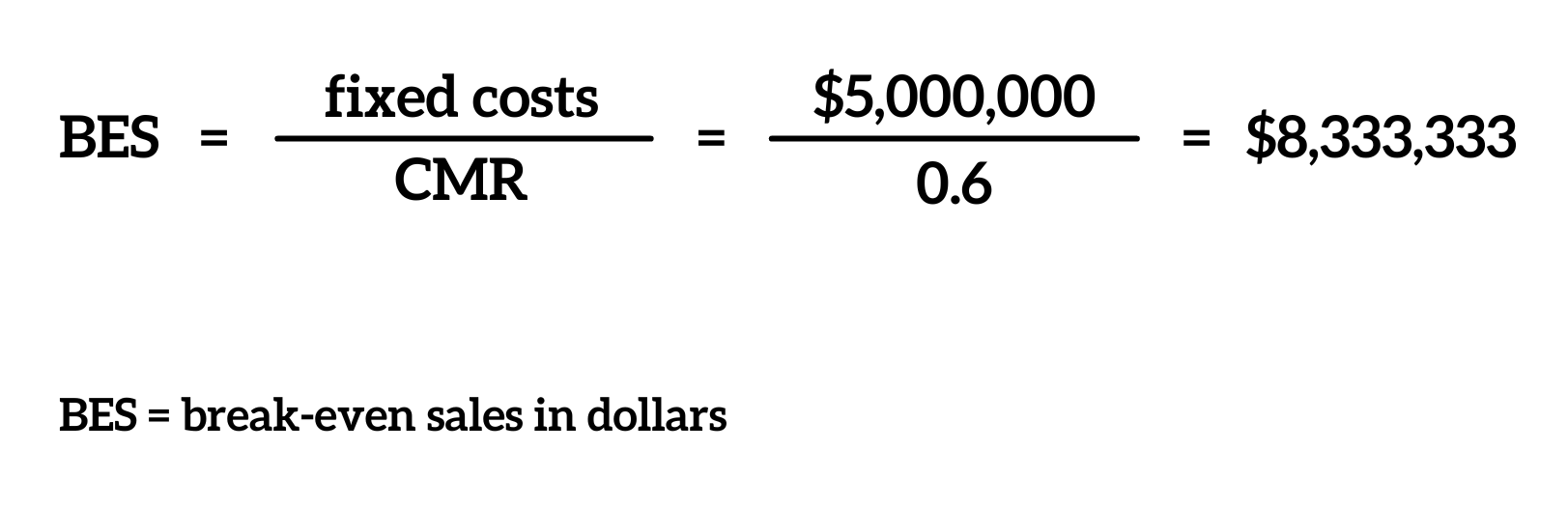

The ratio can help businesses choose a pricing strategy that makes sure sales cover variable costs, with enough left over to contribute to both fixed expenses and profits. It can also be an invaluable tool for deciding which products may have the highest profitability, particularly when those products use equivalent resources. In general, the higher the contribution margin ratio, the better, with negative numbers indicating a loss on every unit produced. The Contribution Margin Ratio is a measure of profitability that indicates how much each sales dollar contributes to covering fixed costs and producing profits. It is calculated by dividing the contribution margin per unit by the selling price per unit.

Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation or shipping costs (variable costs). These costs may be higher because technology is often more expensive when it is new than it will be in the future, when it is easier and more cost effective to produce and also more accessible. A good example of the change in cost of a new technological innovation over time is the personal computer, which was very expensive when it was first developed but has decreased in cost significantly since that time. The same will likely happen over time with the cost of creating and using driverless transportation. Understanding these metrics allows business owners to see beyond gross profit figures, diving into how individual products or services perform.

To convert the contribution margin into the contribution margin ratio, we’ll divide the contribution margin by the sales revenue. For example, if your business sells a product for $100 per unit, and the variable cost per unit is $40, then for each unit sold, the contribution margin is $60. This $60 contributes towards covering the fixed costs and, after those are covered, to the profit. The concept of contribution margin has been central to managerial accounting and financial analysis for decades, providing a straightforward way to evaluate the profitability and efficiency of sales. It helps businesses focus on covering fixed costs and achieving profitability. Contribution Margin is a key financial metric used to determine the selling effectiveness of a product by subtracting variable costs from sales revenue.

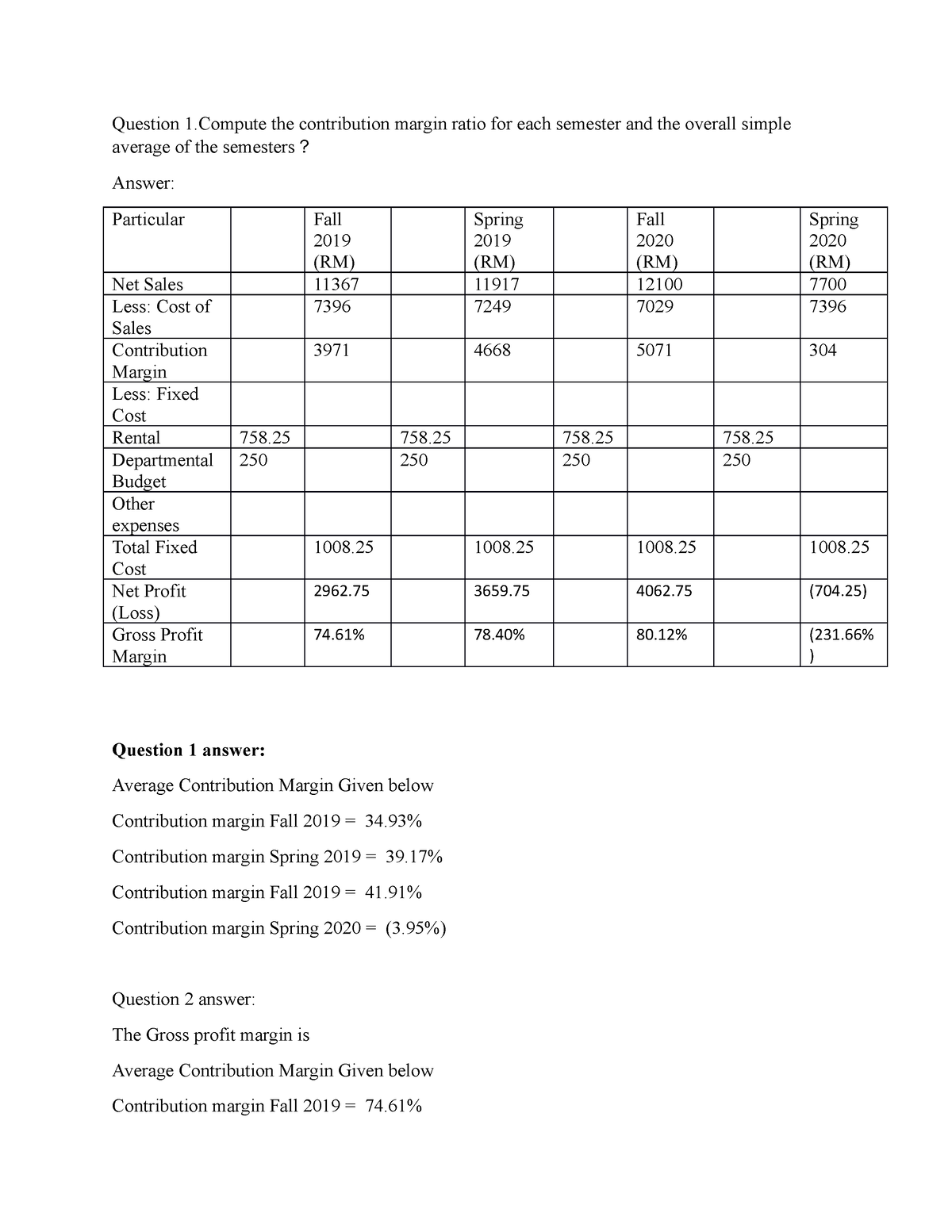

Every product that a company manufactures or every service a company provides will have a unique contribution margin per unit. In these examples, the contribution margin per unit was calculated in dollars per unit, but another way to calculate contribution margin is as a ratio (percentage). Contribution margin ratio is a calculation of how much revenue your business generates from selling its products or services, once the variable costs involved in producing and delivering them are paid. This can be a valuable tool for understanding how to price your products to ensure your business can pay its fixed costs, such as salaries and office rent, and still generate a profit.

The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. However, ink pen production will be impossible without the manufacturing machine which comes at a fixed cost of $10,000. This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced.

This resulting margin indicates the amount of money available with your business to pay for its fixed expenses and earn profit. In other words, contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. Accordingly, the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price. You might wonder why a company would trade variable costs for fixed costs.

These ratios provide insight into the overall profitability of a business from different perspectives. Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits. For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company. While there are plenty of profitability metrics—ranging from the gross margin down to the net profit margin—the contribution margin metric stands out for the analysis of a specific product or service. The Contribution Margin Ratio is the product revenue remaining after deducting all variable costs, expressed on a per-unit basis.

发表回复